ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.

Scope

This report serves as an update and addendum to ICTC’s Canada’s Growth Currency: Digital Talent Outlook 2023 report released in November 2019.

The Digital-Led New Normal examines the unprecedented economic shock of COVID-19 and other economic influences to provide an updated GDP and employment forecast for the Canadian economy, the digital economy, and the six key innovation areas outlined in the 2019 forecast:

- Cleantech

- Agri-foods and food tech

- Interactive digital media (IDM)

- Advanced manufacturing

- Clean resources

- Health and biotech.

At a Glance

Revised Employment Forecast to 2022:

- By Q4 of 2022, the digital economy is expected to have recovered from the initial shock, reaching over 2 million workers, representing roughly 10.5% of all employment in the Canadian economy at the time

- ICTC’s baseline scenario forecasts that increased demand for employment in the Canadian digital economy will total 102,000 between Q1 of 2020 and Q4 of 2022.

(ICTC’s original forecast released October 2019 anticipated the demand for digitally skilled talent in Canada to reach more than 305,000 by 2023, with total employment in the Canadian digital economy reaching more than 2.1 million.)

Global Economic Shocks

COVID-19 took centre stage in 2020 and will likely continue to destabilize supply chains worldwide in 2021.

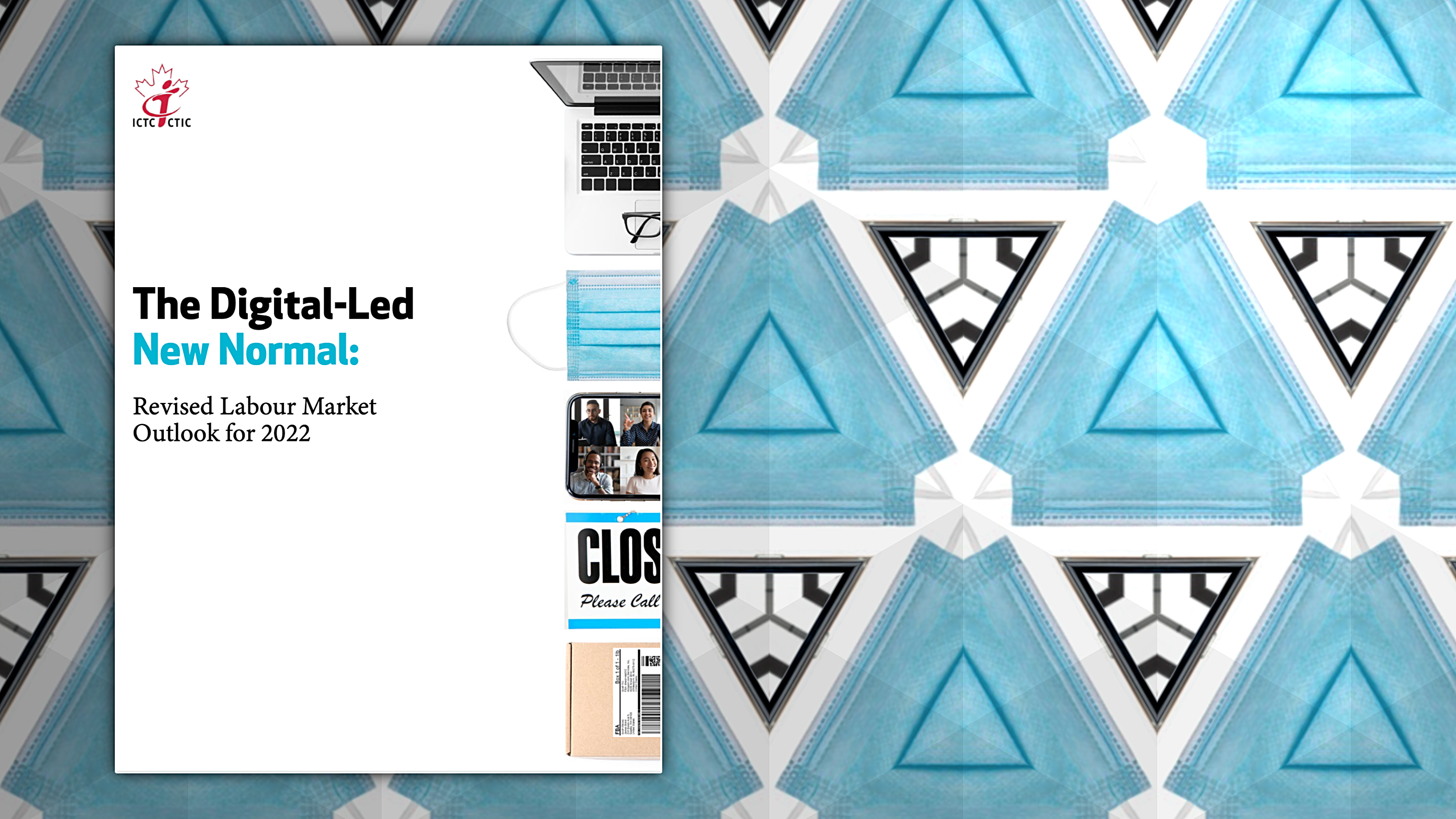

A global pandemic was declared in mid-March 2020. The global spread of the pandemic and the resulting stay-at-home orders and lockdowns is considered the largest shock to the Canadian economy since the end of the Second World War. The Canadian economy entered a recession in the same month.

The ensuing the peak unemployment rate of 13% is the highest rate of unemployment recorded in Canada since the Great Depression.

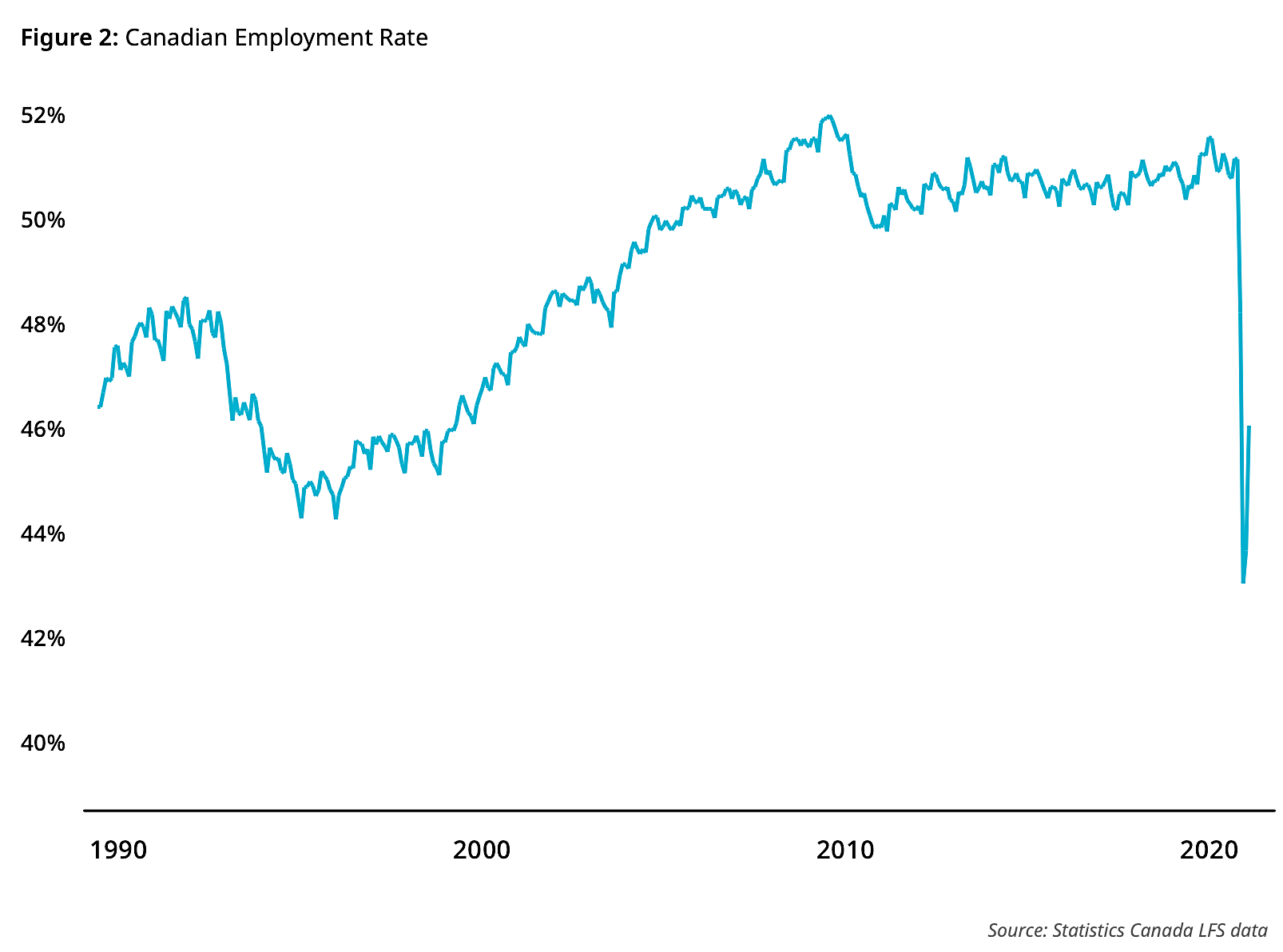

GDP loss estimates varied across institutional sources.

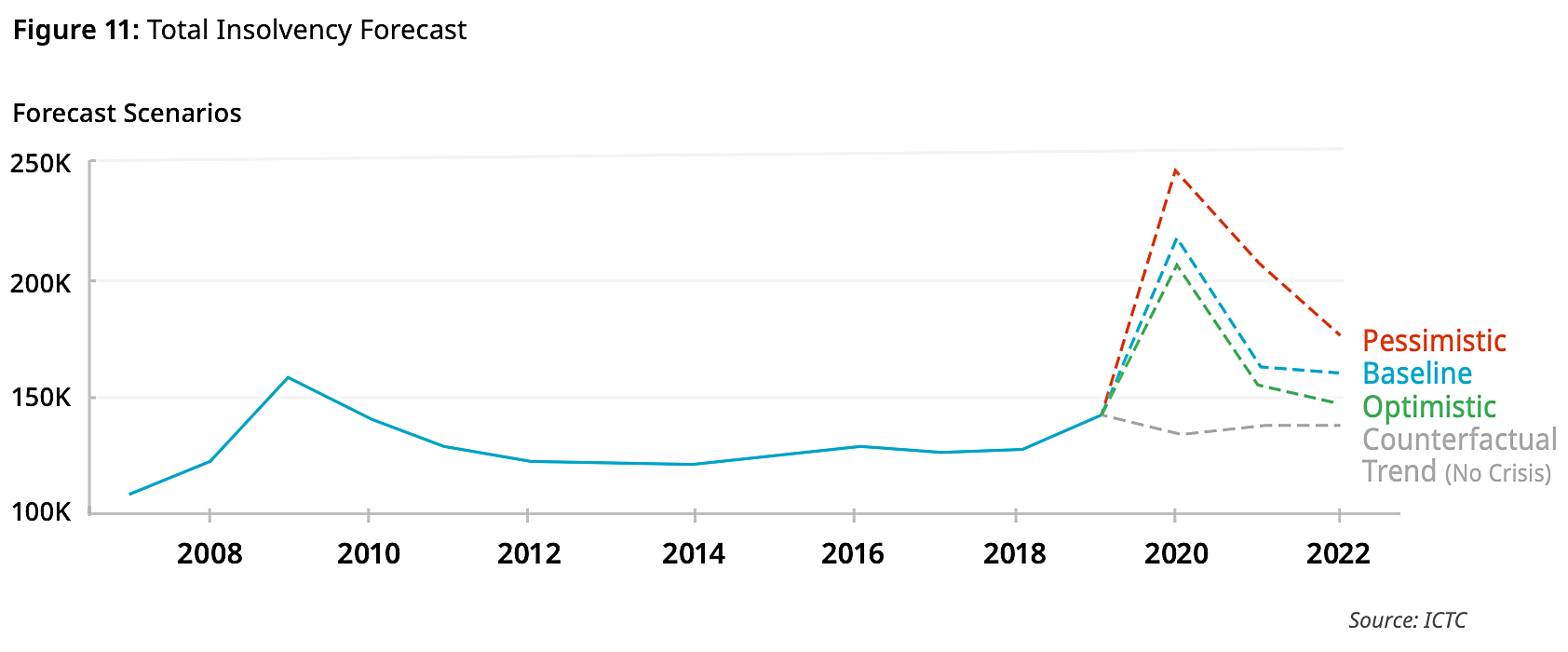

Business insolvencies spiked in 2020.

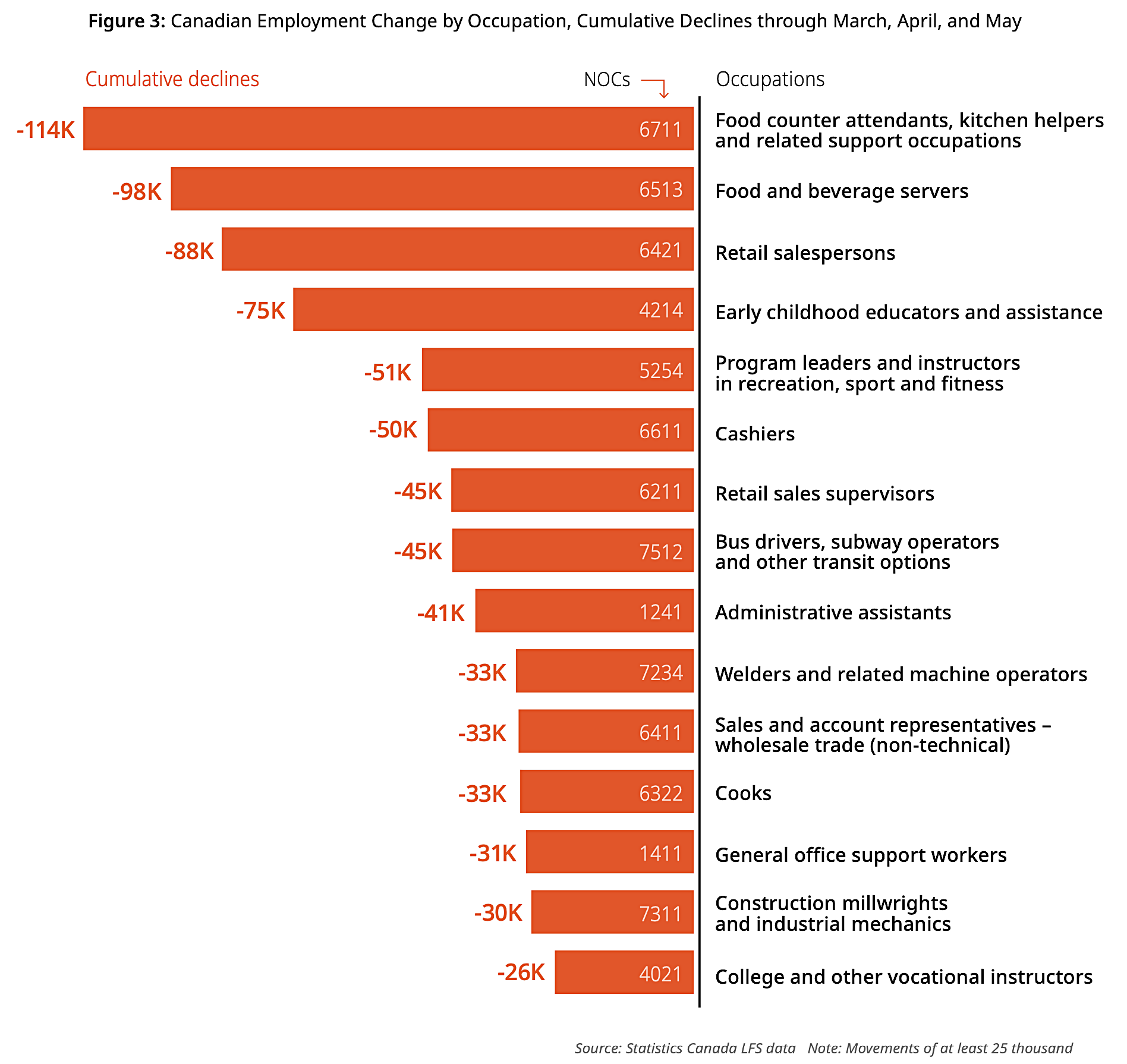

COVID lockdown job-losses varied across sectors.

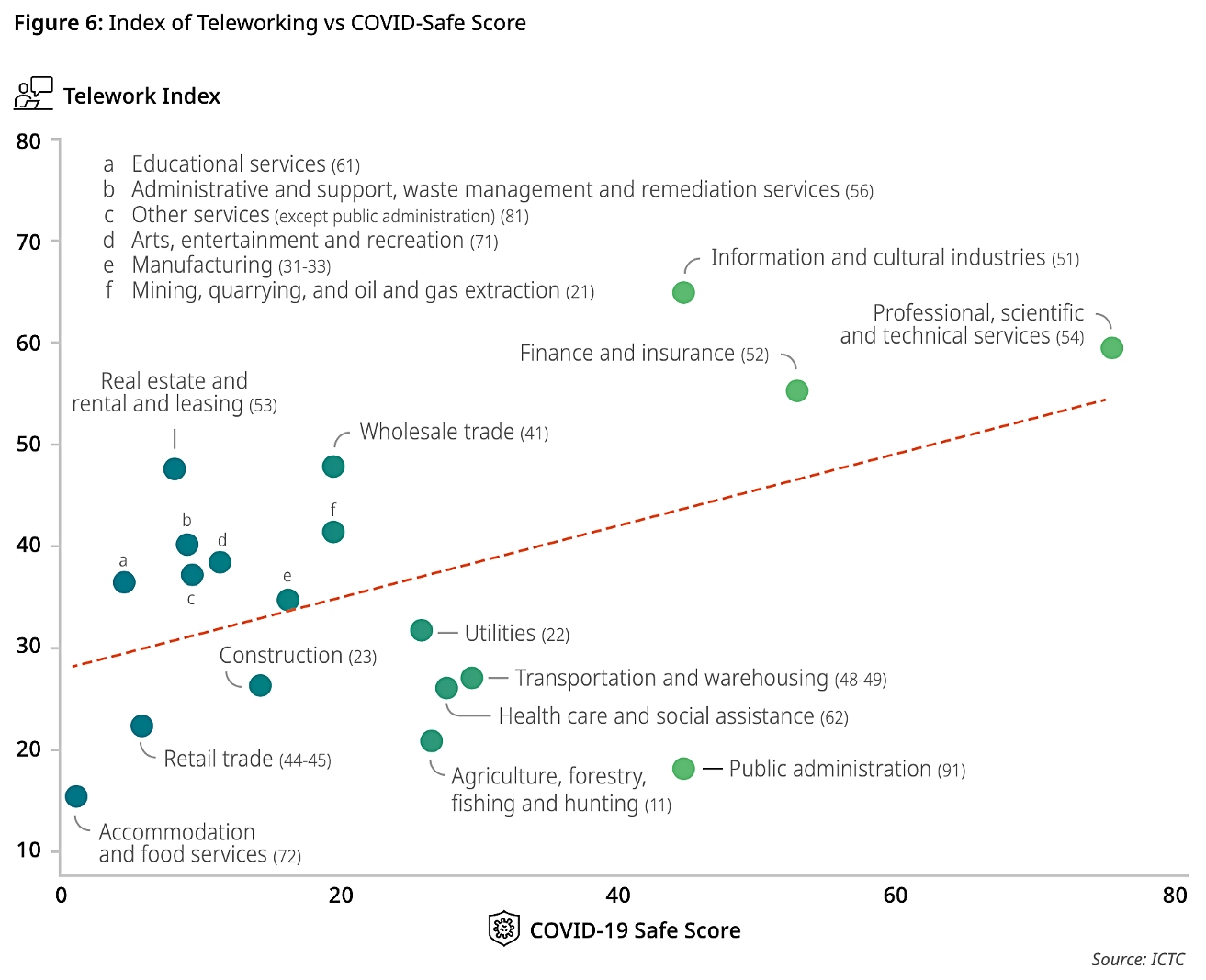

Many professions turned to online work.

Other Economic Shocks

COVID took centre stage but other economic shocks that impacted the Canadian economy in 2019/20 included the United Kingdom’s exit from the European Union, protests that temporarily halted the construction on a pipeline project for supplying natural gas to a British Columbia LNG mega project, and a further collapse in Canadian crude prices.

Brexit: Great Britain’s exit from the European Union on January 31, 2020, is a potential disruptor of business relationships, including in the digital economy.

- The UK is Canada’s fifth largest trade partner (after the US, the EU, China, and Mexico) and represents around 3.3% of Canada’s total trade

- Two-way Canada/UK trade totalled $29.04 billion CAD in 2019

- The UK is one of the largest export markets for Canadian technology goods and serves as a base for Canadian technology service companies accessing the European market

Key uncertainties around Brexit include how the UK leaves the EU, what kind of deal is implemented with Canada, and whether the new deal is implemented before or after the UK’s departure from the EU.

Canada-UK trade will no longer be subject to CETA in 2021. Canada will need to negotiate a new trade agreement with the UK to avoid losing tariff reductions negotiated under CETA.

It is unlikely that Brexit will substantially disrupt Canada’s digital economy.

Wet’suwet’en Protests: In January 2020, a dispute between energy pipeline company TC Energy (formerly TransCanada) and the Wet’suwet’en First Nation hereditary chiefs escalated into national protests, which led to a slowdown of the Canadian economy, largely because of the accompanying rail blockades.

- The Parliamentary Budget Office estimated that the blockades reduced Canadian GDP growth by 0.2% in the first quarter, and 0.01% for the entire year.

Oil Price Collapse: Commodity prices, especially for oil and base metals, declined significantly in early March due to demand erosion as the COVID-19 worldwide lockdowns were enforced.

- Oil price declined further, exacerbated by a production supply glut

- In April, the average price of Western Canada Select was 90% lower than its level in January

A slow recovery in oil prices is expected, potentially hampered by subsequent waves of COVID infection.

Canada’s Future Digital Economy

During the initial wave of COVID-19, many tech firms have avoided substantial losses, and some technology subsectors (video gaming and animation) benefited from lockdowns.

- Tech firms more easily shifted to online work, compared to other sectors.

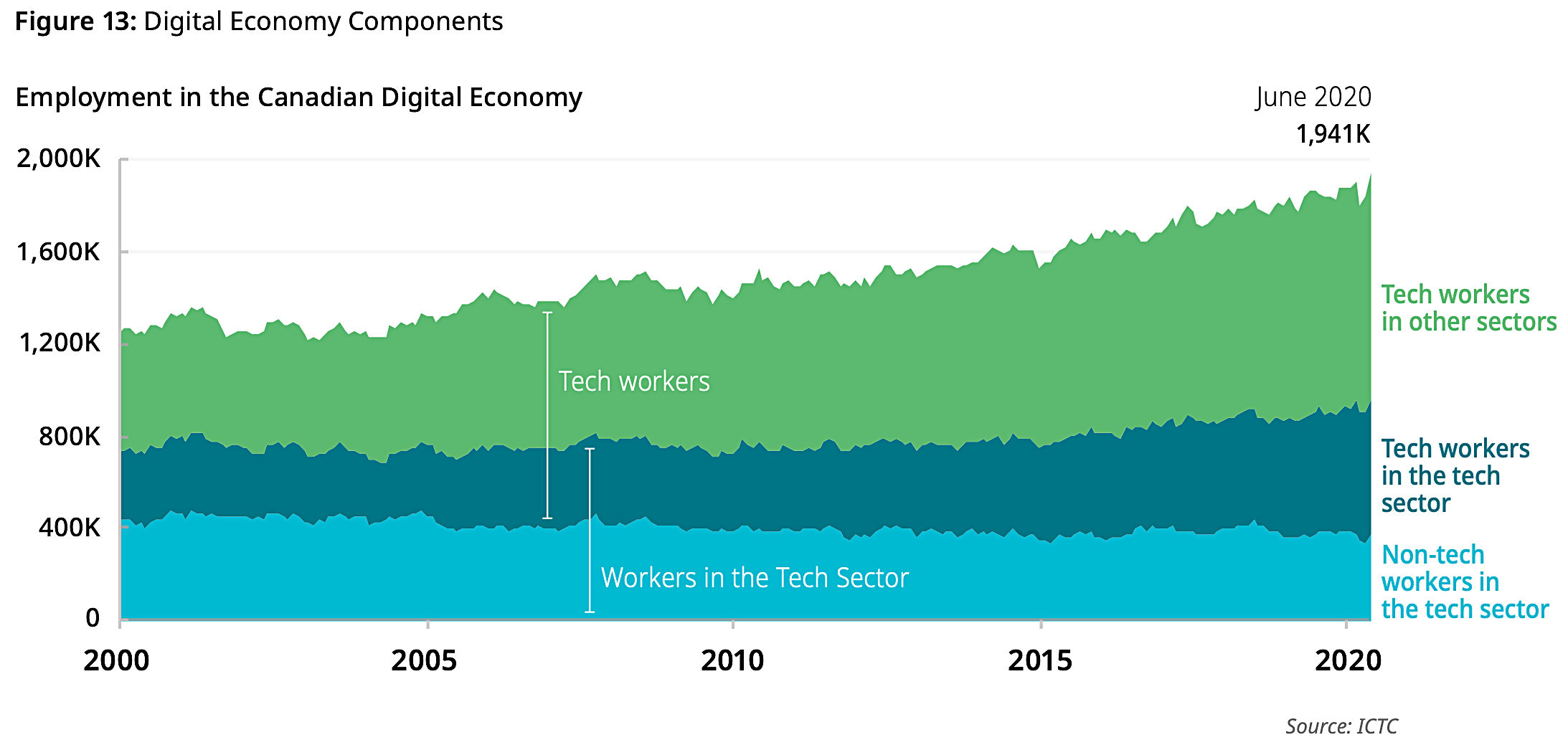

The digital economy includes both tech jobs in any sector and non-tech jobs in the ICT sector (without double counting)

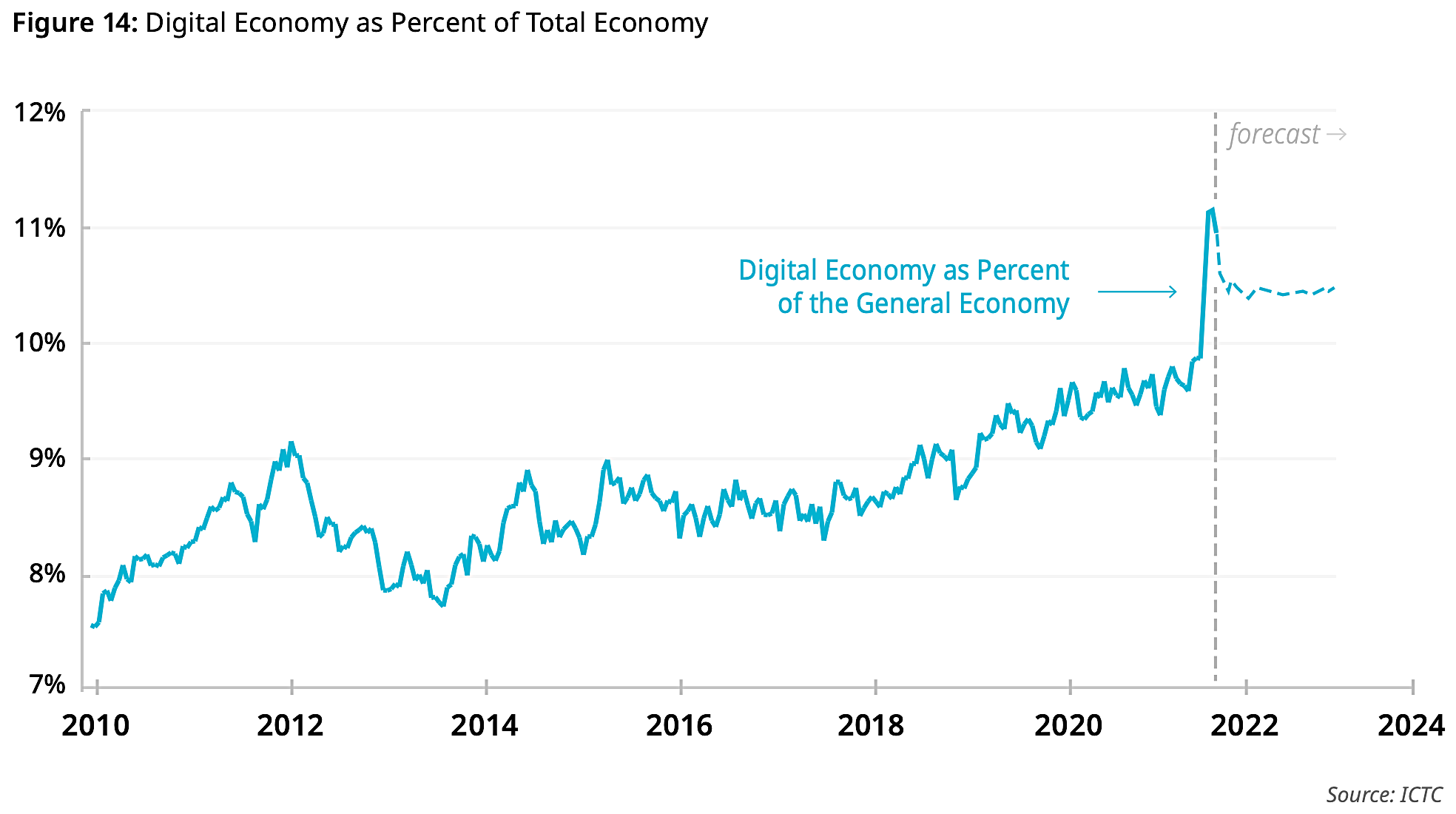

The digital economy has grown over the last decade as a percentage of the total economy. In March and April 2020, it jumped an additional 1% (due to mass layoffs in hospitality and education sectors).

Detailed Revised ICTC Forecast

- By Q4 of 2022, it is expected that the digital economy will have recovered from the initial shock, reaching over 2 million workers, or roughly 10.5% of all employment in the Canadian economy.

- According to the baseline scenario, ICTC forecasts that increased demand for employment in the Canadian digital economy will total 102,000 between Q1 of 2020 and Q4 of 2022.

(ICTC’s original October 2019 forecast anticipated the demand for digitally skilled talent in Canada to reach more than 305,000 by 2023, for total Canadian digital economy employment reaching more than 2.1 million.)

Six Key Innovation Areas:

Recent Developments and Employment Forecasts

Cleantech: business focused on environmentally friendly goods and services (water, wastewater, solid waste management, etc.) or alternative energy (bioenergy, wind, solar, smart grid, etc.).

Canadian cleantech continues to expand, much of it recently through business/government partnerships

- An estimated 850 cleantech firms operate in Canada

- Cleantech represented over 3% of Canada’s GDP and over 250,000 jobs in 2017

Cleantech is positioned for growth as many nations around the world — including Canada — call for a renewed focus on climate-neutral energy generation and practices following the end of the pandemic.

By Q4 of 2022, Canada’s cleantech sector is expected to employ approximately 319,000 workers. Demand for workers will total approximately 16,000 between Q1 2020 and Q4 2022, under a baseline scenario.

(ICTC’s original 2023 forecast for cleantech employment demand was approximately 25,500 workers by 2023, for total potential employment to more than 316,500.)

Photo by Colin Watts on Unsplash

Advanced Manufacturing: development and adoption of digital technologies (robotics, 3D printing, etc.) to create new products, enhance processes, and improve manufacturing efficiencies.

- In 2019, manufacturing employed more than 1.7 million people

- Accounted for 10% of the Canadian GDP

- 68% of all of Canada’s merchandise exports

COVID-19 disrupted manufacturing operations in Canada on a large scale. Many businesses were forced to rethink their manufacturing operations and advanced technology and digital enablement are quickly becoming an essential part of a resilient manufacturing sector.

ICTC expects employment in cleantech to recover to pre-COVID levels by Q4 of 2022, when employment profiles for the sector are likely to see notable shifts.

(ICTC’s original 2023 forecast anticipated only a modest demand of approximately 8000 workers in advanced manufacturing occupations by 2023, bringing total potential employment to over 300,000.)

Agri-Tech and Food Tech: traverses several subsectors, including animal genetics, industrial bioproducts, regular agriculture, and livestock rearing.

- Agri-food and food-tech accounts for about 2.9% of Canada’s GDP and 12% of total exports

- In 2018, the Canadian government’s Agri-Food Economic Table set an ambitious export goal of $85 billion in agriculture, agri-food and seafood products by 2025

- By 2025, Canada aims to become one of the top five countries in agri-food

COVID-19 has also reemphasized the need for more digitization to reduce physical contact and labour requirements within the food processing subsector.

ICTC expects employment in agri-food and food tech to dip slightly before recovering to near pre-crisis employment levels by 2022.

(ICTC’s original 2023 forecast anticipated demand for approximately 20,000 agri-food and food-tech workers by 2023, and total employment of more than 672,000.)

Interactive Digital: the intersection of ICT, digital and creative industries, businesses that display data or information in creative or innovative ways, including animation, visual effects, video game development, music, advertising, etc.

- Canada is recognized as a global leader in creative technology (video game production, visual effects, and animation)

- Canada has also shown early leadership in the development of virtual and augmented reality content and technology

The interactive digital sector has the greatest growth potential for Canada following the COVID-19 pandemic; however, the pandemic is straining the cashflows of smaller studios.

ICTC expects continued upward employment growth reaching 830,000 by 2022, which represents the strongest demand for employment among all the innovation areas. Between Q1 2020 and Q4 2022, the sector is expected to see a demand for approximately 55,000 workers.

(ICTC’s original 2023 forecast anticipated a demand for more than 95,000 workers by 2023 in interactive digital media roles, bringing total employment to more than 830,000.)

Clean Resources: the blend of the natural resources sectors and clean technology, including companies in forestry, mining, fisheries, and upstream and downstream oil and gas activities.

- In 2019, the natural resources sector directly or indirectly accounted for 17% of Canada’s GDP

- Approximately 1.8 million directly or indirectly jobs

- Energy is Canada’s largest extractive sector, accounting for 7.9% of national GDP or $187 billion

- Mining accounts for 3.5% or $87 billion

- Forestry accounts for 1.4% or $23 billion

COVID-19 greatly reduced the demand for global transportation and reduced the demand for commodities, with accompanying job losses.

An International Labour Organization report, however, anticipates that by 2030, the transition to a green economy could bring net job gains in green energy and clean resources extraction.

ICTC expects a demand for approximately 4,000 workers in clean resources from Q1 2020 to Q4 2022, with total employment reaching around 174,000.

(ICTC’s original 2023 forecast anticipated modest demand for approximately 10,500 workers by 2023, and a total clean resources employment of nearly 176,000.)

Health and Biotech: encompasses a wide range of firms, including pharmaceuticals, medical devices, biomedical, digital health solutions, nanotechnology, and digital technology applications in healthcare.

- Encompasses over 900 firms currently in Canada

- Contributes 0.45% to Canada’s annual GDP

- The broader healthcare ecosystem represents 11% of Canada’s annual GDP

COVID-19 has created unprecedented demand for healthcare services and employment. Advanced digital technologies like virtual care, precision medicine, etc. could help make the health system more efficient, effective, and sustainable.

ICTC’s expects employment in health and biotech to return to a pre-crisis growth trend, with an modest demand of approximately 5,000 workers and total employment of 119,000 workers by 2022.

(ICTC’s original 2023 forecast anticipated moderate health and biotechnology demand for roughly 9,000 workers by 2023, and total employment of nearly 120,500 in Canada.)

ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.