ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.

Study Scope

This report examines employment in Canada’s digital economy and forecasts the demand for digitally skilled workers across all sectors of the Canadian economy until 2023.

It also identifies:

- Six key innovation areas driving economic growth across the Canadian economy;

- The 15 most in-demand occupations across the digital economy and their critical skills; and

- Pathways for filling tech employment demand in Canada.

Background

Many sectors of the economy around the world are seeing extensive change as a result of digital disruption and transformative technologies such as Artificial Intelligence, 5G, Virtual & Augmented Reality, 3D Printing, and Blockchain. This shift is redefining talent and skills needs, while changing the way we work, live, and do businesses.

- From 2009 to 2018, employment in Canada’s digital economy grew at 2.5%, twice as quickly as the overall economy

- By the end of 2018, more than 1.8 million people were currently employed in the Canadian digital economy

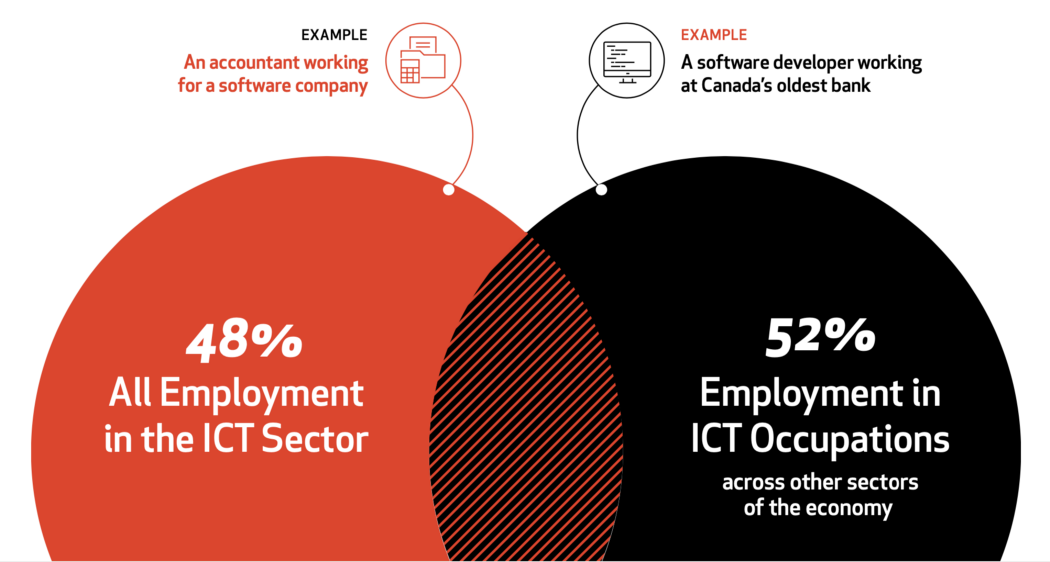

The ICT Sector vs. The Digital Economy

The “ICT sector” refers to businesses that fall within certain digitally enabled industries. The “digital economy” represents the sum of total employment of ICT workers across all sectors, including non-ICT workers within the ICT sector.

Over the last 10 years, the presence of ICT occupations across the economy have grown by 4%, totalling 52% of all ICT workers in Canada in 2019.

Economic Forecasts and ICTC Forecasts

After a slowdown in the Canadian and global economies in 2018/19, the Canadian economy is forecast to gain momentum in 2020, with a 2% growth rate, which aligns with the moderate growth scenario in this Outlook (contractionary and high-growth scenarios are also provided).

Study Findings

ICTC expects the demand for digitally-skilled talent in Canada to reach more than 305,000 by 2023. If filled, total employment in the Canadian digital economy will exceed 2.1 million.

Six Key Innovation Areas

Cleantech: Technology advancing alternative energy and environmental efficiency. Expected demand, 25,500 workers by 2023, for total employment of 316,500. With an estimated 850 cleantech firms operating in Canada, Cleantech is a relatively young industry, but it is already an important source of job creation for Canadians. In 2017, over 3% of Canada’s GDP and over 250,000 jobs were attributed to cleantech.

Photo by Karsten Würth on Unsplash

Clean Resources: Carbon-neutral natural resource extraction or utilization. Expected demand, 10,500 workers by 2023, for total employment of nearly 176,000. The natural resources sector is a pillar of the economy, employing over 1.5 million Canadians in 2018, but the sector also accounts for over 90% of Canada’s greenhouse gas emissions. Efforts to mitigate environmental impacts of resource development is driving this area of innovation.

Advanced Manufacturing: Digitally-enabled processes and technologies that generate efficiencies in manufacturing. Expected demand, 8000 workers by 2023, for total of 300,000. Automation and new efficiencies in manufacturing between 2000 to 2017 reduced Canadian employment in manufacturing to 9.3% from 15%. Substantial advancements in Industrial IoT, 5G enabled data transmission capabilities, artificial intelligence and robotics are still needed for more robust employment demand to take hold in advanced manufacturing.

Interactive Digital Media: Digital and creative industries. Expected demand, 95,000 workers by 2023, for total employment of 830,000. This segment of the ICT sector grew by 24% from 2015 to 2017 alone, according to the Entertainment Software Association of Canada.

Health and Biotechnology: Technology that improves processes or expands access to health products and services. Expected demand, 9,000 workers by 2023, total employment of 120,500. Government expenditures on healthcare already exceed 10% of GDP and are expected to rise with the aging population. Innovations in healthcare and biotechnology will be critical to containing healthcare costs and maintaining a high quality of life high for Canadians.

Agri-foods and Food-tech: Technology directed at environmentally-friendly and sustainable food production. Expected demand, 20,000 workers by 2023, total employment, 672,000. Consists of several subsectors, including animal genetics, industrial bioproducts, crops, dairy and many others. Industrial bioproducts alone contains over 200 Canadian firms.

Top 15 Occupations Across Canadian Digital Economy

Consultations with employers across the digital economy identified the following in-demand digital roles and supporting business roles that will guide and shape the country’s future economy:

- Software Developers

- Data Scientists

- Data Analysts

- UX/UI Designers

- Full stack Developers

- Cybersecurity Analysts

- DevOps Engineers

- Machine Learning Engineers

- Database Administrators

- IT Support Specialists

In-demand Business Roles

Consultations with employers across the digital economy identified the following in-demand digital roles and supporting business roles that will guide and shape the country’s future economy:

- Business Development Managers

- Project Managers

- Business Analysts

- Digital Marketers

- Researchers

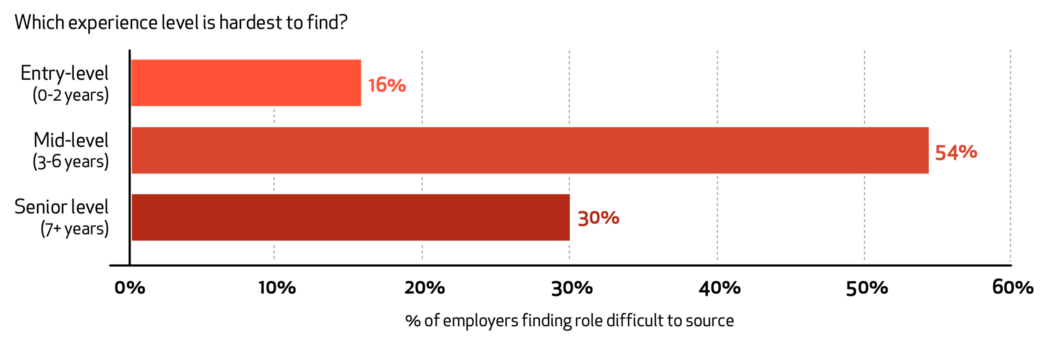

Which experience level is hardest to find?

Pathways to Filling Industry Demand

- An aging workforce requires effective attraction and retention of youth for digital roles. Canadian universities are responding with new programs for the digital economy. Enrollment and graduation from STEM fields is also on the increases at Canadian universities.

- Women make up approximately 25% of employment in “traditional” tech jobs, i.e., software developers. In growing industry verticals such as healthcare, biotech, creative industries and others, women now represent approximately 32% of the digital workforce. Breaking down systemic barriers that keep women from tech roles will be key.

- Immigration will be even more important in satisfying ICT employment demand. In 2009, roughly 30% of workers in ICT roles were foreign born. In 2018, that climbed to 40%. About 60% of immigrants are admitted under the skilled worker or entrepreneur category. Total immigration is also increasing (from 245,290 per year in 2009 to 303,260 per year in 2018).

- Career Transitioners, Indigenous Peoples, and Persons with Disabilities are additional pathways to meeting the digital-skills demand. Upskilling, retraining, and lifelong learning are becoming common workplace themes.

- An estimated 140,000 people working in the Canadian ICT sector identify as having a disability. Removing barriers to entry could increase this number.

- Of Indigenous persons living in Canada, only 1.5% were employed in the ICT sector in 2018. Culturally relevant, community-driven training and upskilling could attract more Indigenous peoples to ICT roles.

ICTC Overviews summarize findings from full-length studies. To read the original report, visit it here.